tax relief 2019 malaysia

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Disabled individual - additional relief for self.

Corporate Tax Rates Around The World Tax Foundation

An individual is regarded as tax resident if he meets any of the following conditions ie.

. Individuals whose income is less than Rs25 lakh per annum are exempted from tax. 20 May 2019 International treaty. Malaysia Maldives Malta.

The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. Best Sellers of 2019. IRS Tax Forms 2009.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Get the latest international news and world events from Asia Europe the Middle East and more. IRS Tax Forms 2018.

Would lead to a bulk selling of assets just before the start of the 200809 tax year to benefit from existing taper relief. Americas 1 tax preparation provider. December 2019 2 November 2019 3 September 2019 19 August 2019 2 July 2019 4 June 2019 1.

Regional and municipal budgets and by separate employers tax payments but medical aid in state and municipal health establishments in all cases is available for free to all citizens foreign permanent residents. Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. In my recent article IRS provides automatic relief for late filed 2019 and 2020 returns and penalties paid to be refunded I described the penalty relief granted to taxpayers for late-filed 2019 and 2020 returns that were filed by September 30 2022.

Tax residence status of individuals. Tax pros and taxpayers now have more time to file certain 2019 and 2020 returns to get late-filing penalty relief. Esther Sense an experienced Police Officer from Germany holding the rank of Chief Police Investigator joined EUPOL COPPS earlier this year and aside from her years of experience in her fields of expertise has brought to the Mission a.

Thresholds under which there is relief from VATGST registration and collection as well as information on minimum registration periods etc. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Taxation of automotive diesel per litre - 2019.

In Malaysia for at least 182 days in a calendar year. Chapter 18 also deals with the tax relief provided to the companies in lieu of the charitable. IRS Tax Forms 2020.

And tax exemptions on house rent allowance leave travel concession etc. CFR Title 33 Navigation. Material Handling Equipment Market 2019.

Our Cybercrime Expert at EUPOL COPPS can easily be described as a smile in uniform. Self-Employed defined as a return with a Schedule CC-EZ tax form. CBS News Live CBS News Pittsburgh.

If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December. Check out this article to find out everything about income tax for sole proprietors and partnership in Malaysia now. In 2019 the total net government spending on healthcare was 36 billion or 123 of its GDP.

Taxation of premium unleaded gasoline per litre - 2019. The tax payable amount under marginal relief will be Rs 14. CFR Title 38 Pensions Bonuses.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Individual Tax Relief and Business Expenses. If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us.

Meet our Advisers Meet our Cybercrime Expert. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. In mid-April 2019 the Coalition government announced that it would.

Tax policy responses to COVID-19. Taxation of light fuel oil for households per litre. Bulk Material Handling Market Slowly But Steadily Gaining Momentum To Reach 5683 Bn Mark In 2026.

Over 500000 Words Free. Our experienced journalists want to glorify God in what we do. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

From January 2016 there is an income tax relief of MYR 25000 per annum for SOCSO contribution. YA 2022 RM Self. Free shipping for many products.

Tax Forms by Year. At the best online prices at eBay. Income Tax Slab for Financial Year 2019-20.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. From January 2019 all the foreign employees are liable to contribute SOCSO. Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 How To File Your Taxes For The First Time.

Local News Weather. Collagen And Gelatin Market Industry Analysis 2023. Capital Gains Tax rose.

CFR Title 32. Mortgage loan basics Basic concepts and legal regulation. Content Writer 247 Our private AI.

Asteriskservice Announced Custom WebRTC Solutions. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Tool requires no monthly subscription.

Double Taxation Relief for companies. Petroleum income tax. Engine as all of the big players - But without the insane monthly fees and word limits.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity. The complexity of Malaysias tax regulations means it may. Find many great new used options and get the best deals for 1965 Canada Silver Dollar Type 1 Small Beads Pt 5 PCGS MS64 Beautiful Toning.

Till FY 2019-20 there was only one tax regime with four tax slabs and tax rates. In 2019 that trend continued as Malaysias GDP reached an estimated 3653 billion with 43 growth. Public Bank and Public Islamic Bank To Increase Its Loan Financing Reference Rates By 025 Public Bank will increase its Standardised Base Rate SBR Base Rate BR and Base Lending Rate BLR Base Financing Rate BFR by 025 effective 12 September 2022 in line with Bank Negara Malaysias Overnight Policy Rate OPR hike by 25 basis points from 225 to 250 on.

No other taxes are imposed on income from petroleum operations. Further to bring down the gross total income an individual was allowed to claim deductions under sections like 80C 80D etc. Non-residents are subject to withholding taxes on certain types of income.

For my 2019 return I was considered as. Other income is taxed at a rate of 30. Global Nebulizer Accessories Market Research Report 2019-2024.

Featured on our Blog. 1 online tax filing solution for self-employed.

Tax Incentives For Green Technology In Malaysia Gita Gite Project

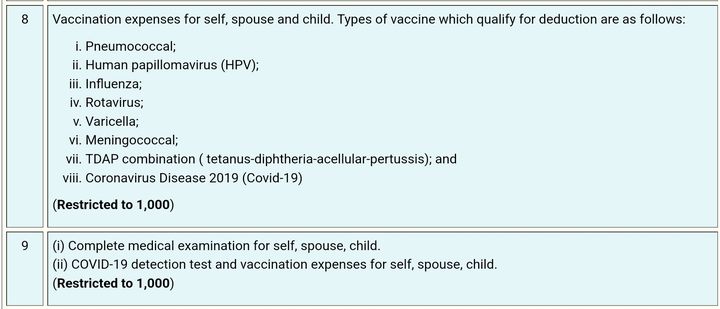

Covid 19 Test Kits Vaccinations Are Tax Deductable For Year 2021 Trp

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

A Guide To Maximize Your Income Tax Filing In 2022

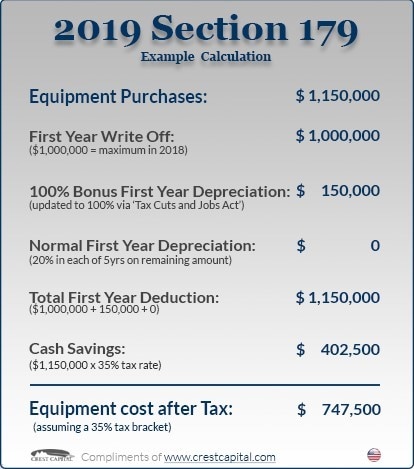

Section 179 Tax Deduction Imperial Ford

Finance Malaysia Blogspot 2016 Personal Income Tax Relief Figure Out First Before E Filing

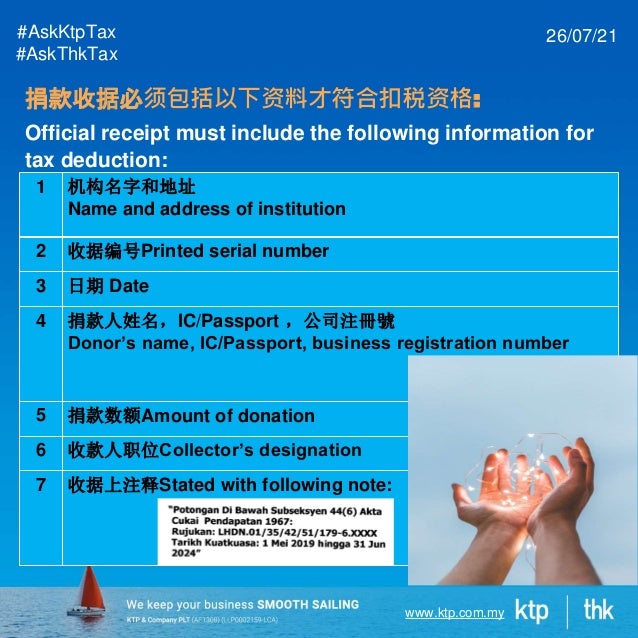

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

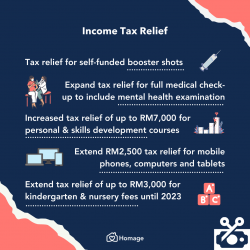

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

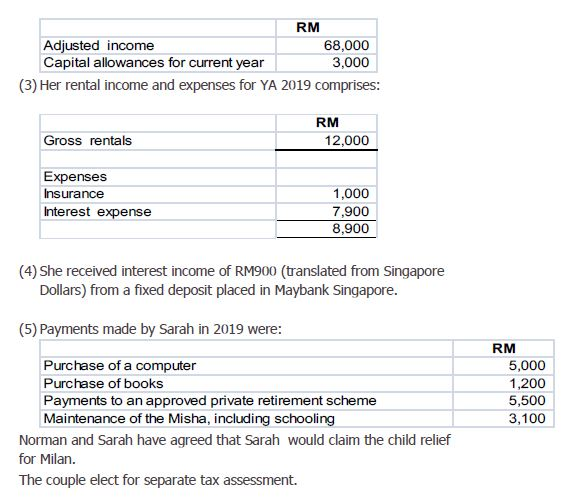

7 Norman And Sarah Who Are Married Are Both Chegg Com

Corporate Tax Rates Around The World Tax Foundation

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Moss Barnett Minneapolis Minnesota Law Firm Attorneys Lawyers

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Shiftal P2p Exchange Shiftalofficial Twitter

0 Response to "tax relief 2019 malaysia"

Post a Comment